The Definitive Guide to Shopify’s Platform Strategy in 2022

Full Steam Ahead for Shopify

It’s 2022 and Shopify is executing at the top of its game. If you’re another platform, it’s probably hard to even get into an RFP. Many brands I speak with are either with Shopify today, or are upset that Shopify has some limitation that precludes you from working with them.

If you are a growing Shopify Plus brand that perhaps needs more flexibility than the platform provides, you might be frustrated with the still-closed nature of certain parts of the platform and hope they stop thinking about fulfillment and start thinking about catering to the needs of the mid-market.

If you are an application developer, however, it’s gold-rush time in Shopify-land. I’ve never seen my Twitter feed so full of people providing tips how to DM 20 of your friends so you could start the next Shopify app.

If there’s one phrase which captures Shopify’s status in 2022 it’s Full Steam Ahead.

What You’ll Find Here

If you follow me on LinkedIn or on this newsletter, or on my podcast, you already know that I write a lot about Shopify. Sometimes nice things, sometimes not so nice things. But for all this writing, I didn’t have one place that captured the sum of my current thinking about the company.

That’s the goal of this document.

Shopify’s Investments

You may have seen that Shopify announced its Full Year 2021 earnings results.

In the short-term, they have some headwinds in 2022 related to COVID annualizing, not to mention the developer revenue changes ($1M credit) annualizing.

In Q4, Shopify lost $500M on its investments (likely Global-E and Affirm) as those stocks declined in the last 6 months and year significantly. Perhaps they should stop playing the stock market and spin out their investments into a separate fund or something? Seems like it would make sense.

An abundance of Shopify’s latest investments relates to its app store and fulfillment initiatives. The company has decidedly refactored itself with its last UNITE conference. It has officially recast itself as a platform company and reinvigorated its App Store mission.

In doing so, it has placed itself firmly in the "Microsoft camp" rather than the "Apple" camp. $1M of no commissions, and lowering commissions to 15% after that. This is huge for innovation. They’ve positioned themselves light years ahead of everyone else in this simple but critical concept. They are clearly trying to correct some of their biggest pain points: Store Customization (Themes and Metafields), Checkout, Payments, and Cart. There are big changes coming for these areas. In some sense, we are still waiting on those changes (Checkout). In other areas, like Online Store 2.0 Themes, they are already here.

Furthermore, Shopify has announced a partnership with Shippo, a shipping software provider, to power the back-end technology of its label printing and tracking solution in Europe, in particular the United Kingdom, France, Spain, and Germany. Shopify has been investing significantly in expanding its European business and shipping is a missing component. Shopify gets a shipping solution that allows its smaller merchants to print labels easily. This same technology will also likely power the tracking behind the scenes of the Shopify Shop App in the future.

I know many are interested in understanding Shopify's strategies moving forward. Throughout this article, we’ll cover their positioning against top competitors in the headless space and against Amazon. We’ll also discuss what Shopify does well, namely their app store. I’ll do my best to lessen the confusion regarding the status of Shopify Fulfillment Network. There is a lot of missing information here and an abundance of gaps to fill. The main questions the company should focus on is: What will keep shoppers motivated to keep shopping here? Are we in a good position to compete in the space? Shopify does have a lot of growth potential, and it’ll be interesting to see how they will continue to move forward.

Shopify Fulfillment Network

As we’ve seen with Shopify’s latest partnership with Shippo, they’re looking to invest heavily in their fulfillment capabilities. I’d say for good reason because there are a lot of rumors and reports about what is going on with Shopify's Fulfillment Network in the last year.

Here are the things you really need to pay attention to:

In the last 10 years, great logistics talent goes to 3 places: Target, Walmart and Amazon. For Shopify to become great at fulfillment, it would have to become exactly like the empire it so loathes. "I don't get my Amazon parcels on time" and "I think the Target curbside experience needs improvement." said no one ever.

Shopify has no Chief Supply Chain Officer or even a category for supply chain on their job site.

Their strategy has changed more than once from reports telling me for years they have been essentially white-labeling a third-party solution (without publicizing this widely), to building out a fulfillment center outside of Atlanta of all places. I have a pretty good idea what I would find if I walked through that facility, and the words "best in class" would probably not be uttered.

No one at Shopify is talking about what modern brands need from a fulfillment solution:

Amazon FBA Prep and FBM support.

Ability to ship pallets and case-packs to wholesale partners.

Ability to ship parcels to consumers.

Last-mile options

We have seen enough to know it's not working. For those of you lucky enough to have watched the launch of FBA, it was simply brilliant. A watershed event in the fulfillment landscape. There were no 2 years of tests and learning. Like AWS, their first launch "just worked" and it kept getting better.

Finally, Shopify did not even follow the relatively easy example of Walmart in this space. Partner with a third-party first, advertise it. I'm sure someone like Deliverr would have been more than happy to take the business.

Optimizing Shopify’s Fulfillment Strategy

Supply chain doesn't work without scale. Shopify is about entrepreneurs. The vast majority of entrepreneurs have low volume because they are just starting out.

So, what should Shopify do about fulfillment? Let's get the simple part out of the way first. It should not build a stick of infrastructure. But what then?

Here are my top two ideas for Shopify:

Create a "5PL Marketplace" platform for the procurement of supply chain services by entrepreneurs and brands. This would have 3 components.

Data. Shopify has more data on fulfillment services than most other sources in the world, and the data it does not have or that may be incomplete, many providers would be motivated to cooperate with them due to their market power.

Reviews. It's very hard to find a great provider that meets your standards, handles your category, type of goods, and is close to your particular consumers.Most people just ask a buddy, and to their detriment.

Standard Connectivity. One of the challenges with moving 3PLs is that each one has their own integration standard. Some use EDI, some flat files, others have a Shopify Connector. tor. Some have their own OMS or WMS, some have neither.

Shopify could enforce standards here or even create their own, and it would be widely adopted. It is more likely that Shopify can find an architect to design a reusable 3PL or 4PL integration platform than Shopify can run its own set of nationwide warehouses, or even stitch together its own white-label partner network.

Evolve Shopify Flow into a modern, lightweight multichannel OMS.

The line between "automate some repetitive tasks via rules" (Shopify Flow today) and the complexity of last-mile inventory providers, in-store inventory, 3PLs, FBA is very wide. Even small brands have complex fulfillment needs that Shopify's software does not contemplate. Simple, yet customizable, orchestration between the various providers procured in Shopify's marketplace would be a must. An investment or two in line with their typical partner playbook could be in order.

These solutions have the following advantages that Shopify's current fulfillment network does not:

Drives Shopify's flywheel. Similar to how their developer ecosystem powers more apps, which drives more merchant adoption.

Easily defensible. This is not an area that existing supply chain behemoths like Walmart, Amazon, or Target can easily encroach on.

Plays to its strengths. Tobi is a developer in a company full of software engineers, sitting on top of one of the richest data assets in the world.

Capital light. Software and data are high-margin businesses. Logistics is not, while at the same time being capital-intensive.

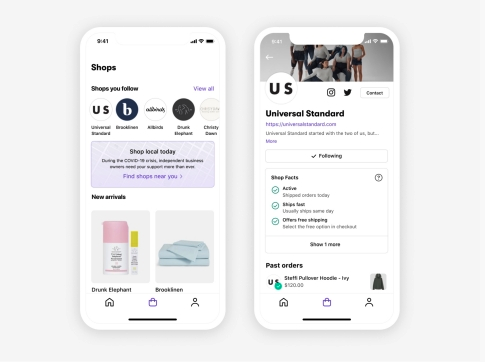

What is Shopify Doing With Its Shop App

It's been widely reported in the last 6 months that Shopify has been testing local search in its Shop App. Doesn't this sound similar to the types of things that Google is testing in its Maps app? It strikes me that Shopify is doing its absolute best to define itself as “not Amazon”, which is not a winning approach. Instead, they’ve adopted an entrepreneurial approach. Yet, their messaging is still not clear.

A few points:

Shopify should give up the "not Amazon" messaging for good and instead define more clearly what and how they are doing for entrepreneurs, and why. It's the "why" part that I still think is missing.

If Amazon is "customer-obsessed", but Shopify is "entrepreneur-obsessed" don't entrepreneurs simply want customers?

Shopify’s App Strategy: A New Direction

I still can’t shake the feeling that Shopify's App strategy is extremely misguided. It should not be focused on its own app (there is no plan), but instead helping its customers create their own apps. Why wouldn't it do this? It would lose control to Apple, oh yeah, and also -- it’s hard to get people to install new apps. It's hard to get people to go to new websites too, but they built a large business around this.

Amazon already has a better app than Shop App. They will not out-innovate Amazon here because they are setting up too many self-imposed "rules" on themselves to ensure they don't end up like Amazon. Amazon doesn't have these same rules on themselves, they just want to do what works to drive more sales.

What should Shopify be doing instead?

I'd like to see Shopify giving the highest quality data to Google Maps instead, let Google innovate on the UI and make Shopify the best default checkout for Google before Bolt or Fast beats you there.

I'd like to see Shopify buy a Customer Data Platform. Which merchant doesn't need better insights into its own customer base?

I'd like to see more video creation tools integrated into Shopify. If video is the basic form of discovery for creators and fans, Shopify's tools are still non-existent here. Help your creators make better content on Shopify than on other platforms.

Shopify vs. Amazon

Shopify has always tried to create this big narrative against Amazon, painting them as the evil empire. Last year, Shopify even ended its native Amazon connectivity, which, like any tax, discourages sellers from going to Amazon [even though you can use third-party tools, it creates friction].

Ultimately, if brand-building and DTC are the way forward, and DTC revenue has higher margins than Marketplace revenue, Shopify should be taking the opposite approach.

Let’s look at 2021 statistics to prove a point:

Who needs who here? And where is the big opportunity for Shopify to grow?

How Shopify Can Utilize Amazon

Throwing a life raft to Amazon sellers. Making it easy to import your Amazon store into Shopify to diversify.

Assuming the above narrative is true, doesn’t Shopify have a great value proposition for these sellers?

Allowing Shopify sellers to diversify their exposure to Amazon.

Many brands on marketplaces know, a big reason they are there is to introduce your brand to customers who don't already know you. This increased awareness is to a consumer what you want to convert to being YOUR owned customer long-term. A great example is helping them know who you are, so that next time they buy, they might go to your website directly instead.

Which means, if Shopify merchants have this strategy, then why would Shopify itself discourage this strategy? Amazon then becomes a growth engine for Shopify long-term. What is holding Shopify back? In my opinion it's "zero-sum" thinking. There is big enough pie for everyone, and brands want to be multiple places. Instead of saying "it's Shopify or Amazon", by embracing Amazon, they create a bigger long-term pie for Shopify.

If by reducing friction, brands don't try to take more business from Amazon to Shopify, then doesn't that mean it is something else Shopify needs to fix?

Getting It Right: Shopify’s Wins

While Shopify does have its struggles, they do have many strong points. Only those who have been through a headless eCommerce RFP can truly appreciate what Shopify has done for eCommerce. There are really only 2 keys to Shopify's performance:

Checkout

It's hard to argue with results, and the performance of the checkout is great compared to the rest of the market. I find it disturbing that a lot of the world is still cobbling together their own Stripe components. Furthermore, the fact that Stripe has not tried to become its own consumer-facing brand is what I believe a huge missed opportunity for them. They have really zero control over their own distribution channels - a tremendous risk for such a large company.

The App Store

Due to the number of merchants on the platform, this attracts the developers. The ease and selection of both great and not so great apps is astounding. Obviously it's important that there is quality, but anyone who has spent time in previous open source ecosystems like Magento or osCommerce knows that extensions were a nightmare of conflicts and maintenance.

While Shopify ecommerce invented the theme language that everyone else adopted, the flexibility has become lackluster. Many of the higher-end Shopify store owners I have talked to have been at least temporarily "saved" by Online Store 2.0, which is a boon for agencies to create the experiences that people need.

Shopify's vision of Checkout is not everyone's vision of checkout. That much is well-documented. There have been and will continue to be a lot of casualties on this road, which brings me to my last point.

Here's my advice to app builders in every generation -- it's not Tobi's job to care about your business. Just like it wasn't Bill Gates' job at Microsoft, and it wasn't Steve Jobs' job at Apple. Think you want to develop a new headphone that works with Apple? Try again. Apple wants to do that too.

Ultimately as the CEO of an app developer, it's your job to understand how you will distribute your product to your customers, and that you are building on a firm foundation. Either you bet on a different set of platforms, and hope the market is big enough, or you start fishing in a different area, on the platform where all the fish are.

Wrapping Up

This article covers Shopify’s latest ventures along with my own thoughts regarding their decisions. I am interested in seeing how Shopify will continue to grow. If their latest investments in Shop, blockchain, and global expansion are any indication, I think Shopify is on the right track to answering the questions we asked at the beginning of this article.

What will keep shoppers motivated to keep shopping at its merchants? If I had to answer, it’s not the entrepreneurial based answer that Shopify themselves would give, but their marketplace seems to be a big priority. They’re investing heavily in search and discovery of products & merchants. If that’s not building a marketplace, perhaps I’m easily fooled.

With new products rolling in, I think Shopify has established itself as a platform that’s capable of competing with Amazon. Which leads us to the last question, Is Shopify in a position to compete in the space? The short answer is yes. The long answer is they have many roadblocks ahead of them, specifically their fulfillment solutions and overall messaging. I don’t think Shopify has a good enough grasp on the message it’s trying to convey. They’re not Amazon, but that message alone isn’t enough. Their fulfillment solution isn’t sufficient enough at its current state, but it’s getting there. So is Shopify.

Looking for e-com strategy help?

Look no further. One of the reasons that I spend so much time writing about companies like Amazon and Shopify is that these are the two largest ecosystems in eCommerce. Every brand, investor, agency, and software company is affected by the moves these two companies make — either directly, or indirectly.

So, if you are in the eCommerce ecosystem somewhere and are looking to launch a new offering, wouldn’t it make sense to seek out advice from one of the deepest thinkers in the space?

Schedule a consultation with eCommerce consultant Rick Watson to learn more.