What’s Next by Rick Watson: Five Reasons Why Amazon Logistics is on the Rise in North America

Everyone knows that Amazon modeled itself in Walmart’s image. This means they understood - from very early on - that supply chain/logistics was a critical component to their long-term success. At the time, even Jeff Bezos admitted he didn’t know a thing about retail.

My, how much has changed in over 20 years!

Building on this theme, I recently took my research down the Amazon Logistics rabbit hole to see what I could find. What I brought to the surface has a lot of implications for what’s next in North American supply chains.

But, first things, first.

1 - Amazon has already launched as an independent shipping carrier in the UK.

For all the noise about the competition between FedEx, Amazon, and UPS in the United States, most of the discussion has been related to the parcel volume within Amazon’s own properties. Some of you may not already know that in the past year, Amazon has launched as an independent shipping carrier in the UK. What this means is that you can use Amazon’s logistics network for non-Amazon parcels. Here are a few things I found interesting about this development:

No public press release - it’s a little odd right? The only mentions I find are two Linkedin posts in the past year, which makes me wonder which one of these launch announcements is real? One five months ago, and one about a year ago. Willing to be misunderstood for long periods of time? I would say so.

Their messaging seems to indicate they are serving the lower and middle tiers of the market - not the high-end. Things like “no contracts” make this obvious. This makes sense because you never want to launch a new service with the most demanding customers - especially if you are still iterating. I suspect they would start by filling in the “dead zones” in their peak fulfillment times — one report mentioned that sellers can’t choose a pickup time. Which is great for Amazon, though not so much for the seller. There is not much to criticize here because I expect this to be an evolving situation which could change even weekly as the program develops.

Amazon is rapidly gobbling up warehouse space in the UK. SHD Logistics reports that Amazon leased one-third of all warehouse space in the ENTIRE UK this summer. I hadn’t seen this stat before, and it kind of blew me away. What’s even more troubling is that eCommerce occupied 33% of the 40% leased to all eCommerce players during the period. Which means the rest of UK eCommerce only leased 7%. What does that tell you?

It was a big announcement last year that Amazon was testing its independent shipping service in the US market, that was later shuttered. I highly doubt that would have been done without COVID - which put considerable strain on Amazon’s network.

Amazon doesn’t build anything that can’t scale (what’s the point?), so I would expect this to rollout worldwide in the next several years — including in the US.

2 - Amazon has recently purchased a $1.5B air hub in Northern Kentucky, set to launch in 2021.

When I first heard a few years ago that in 2016 Amazon, through third-parties, would be operating its own airline, it is one of those moments that makes you stop and wonder. Which huge Amazon bet will come back to haunt them? If not their own airline, then what?

Well, they are investing more. Here are a few fascinating tidbits:

The new facility will be able to support approximately 200 flights a day. This is about half the capacity of FedEx’s Memphis hub which currently runs about 450 flights per day, handling over half of FedEx’s total traffic.

In a fascinating study by a DePaul University research team, one I had not read before this week, ultimately the hub serves much the same purpose as the Memphis hub for FedEx. Furthermore, the DePaul study indicates this new facility will already vault it into the list of the top 3 or 4 cargo airlines in the world, allowing it to expand to up to 100 planes, just at this facility, alone.

“Amazon Air’s robust expansion makes it one of the biggest stories in the air cargo industry in years.”

The bottom line here is these are not the investments of a timid player, unsure of where it’s going. While an investment like this doesn’t indicate that they plan to challenge UPS or FedEx head-on in the next 5 years on the same contracts, it’s clearly a major part of their future independent logistics plans.

3 - USPS is especially vulnerable in the next 2-3 years, and UPS in the next 5-10 years.

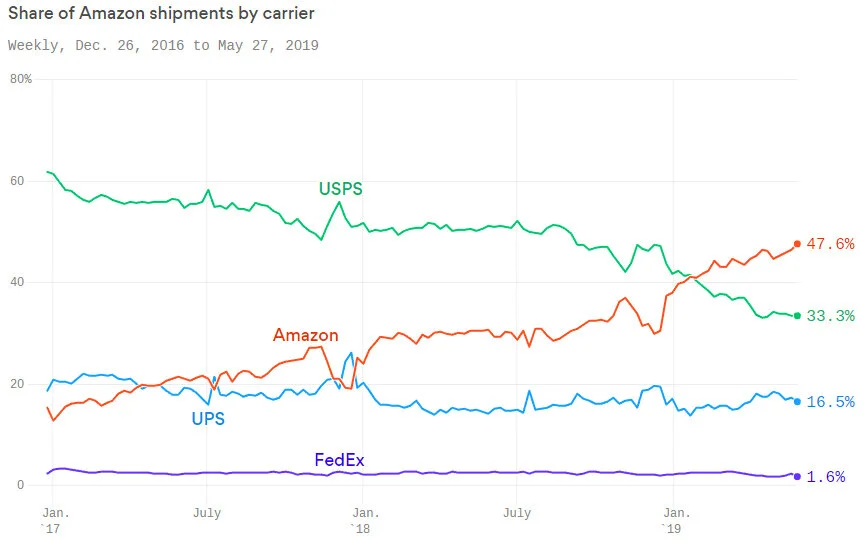

While the battle between FedEx and Amazon gets all the publicity, what gets left behind is that USPS is actually the one with all the exposure. In the last 5 years, USPS share has been estimated coming down from over 60%, to under half of that, somewhere south of 30%

Source: Rakuten Intelligence

And it makes sense. FedEx was never more than 1% of Amazon’s North American network to begin with. Most of UPS’ declines in volume share have already been taken out - and they have settled into a 15% range (though some reports differ) where they will likely stay for same time: routes they can operate more efficiently and profitably than Amazon.

While the USPS has a long and venerable history of innovation, it was never envisioned to keep up with modern supply chain needs. Consumer and tracking tools have fallen behind all of the corporate alternatives, leaving other players like DHL and Pitney Bowes to fill in the tracking and other technology and service gaps in the postal network.

Indeed, USPS is becoming the “carrier of last resort” in modern business - chosen primarily for lower-value items that otherwise would not succeed in an Commerce-oriented environment.

“Imagine this: what is If Amazon Logistics could offer a service without the crippling surcharges of the major carriers, while at the same time offering the ground-based reliability of UPS? The result would up-end the entire industry.”

4 - Amazon Logistics detractors don’t understand the power of marginal cost.

Logistics companies can be forgiven if they mostly care about one thing — if a truck or plane is going in a specific direction, how quickly can we fill it up? The whole idea is that if you have 100 parcels already going in one direction, the marginal cost of the next 20 parcels isn’t a function of the first 100, because the truck was already going in that direction.

Imagine if instead of building a network from scratch, you could build a nationwide logistics network on this principle? Witness:

Amazon is already 50% of the eCommerce market. Which means they have direct control over about 25% of the eCommerce parcel volume in North America by default. No one else has that power.

Something else no other carrier knows? The lifetime eCommerce value of the customers they are shipping to. Whether those items are subscriptions or one-time shipments. What those customers are likely to order next month. You can afford to lose a bit more money subsidizing shipping to more profitable customers.

Something else no carrier has? Control over where items in fulfillment facilities are placed in such large volumes.

To enter the market, Amazon could not only afford to cherry-pick the most profitable routes, according to Axios they could also offer the entire service at their marginal cost - undercutting other carriers by as much as a reported 33%.

But Amazon has other weapons in its arsenal as well. In fact, it’s more like a bazooka.

5 - Amazon has a huge stick and booster in its own growth — it controls the seller performance standards as well.

Amazon is not known for playing fair or nice. In case you forgot the story of Diapers.com, I thought I would remind you about it. While Jeff Bezos learned retail from Walmart, he learned competition from Bill Gates.

What people often forget about Amazon - it’s not a normal company. It controls both the consumer demand, and where that supply is positioned. The key to the entire equation is Amazon Prime - Amazon’s most profitable customers.

In case you didn’t realize, everything on the Amazon website is an equation. Your position, your ranking, your volume, everything. There have even been several academic papers on the topic: here from Northeastern University, and here from the European Joint Research Center.

While it’s widely known in the seller community, what’s not as widely known by the average consumer — if you don’t use Amazon FBA or Seller-Fulfilled Prime, you have no hope of entering the Buy Box. Why is that? Variance, speed, and mistakes.

Shipping carriers make mistakes, and mistakes affect your rating. Amazon often pauses its relationship with carriers based on data they track on every parcel such as OTIF.

“If Amazon wants to drive people to its own logistics service, all it would have to do would wait for other carriers to falter just enough to ban them.”

Indeed, they wouldn’t even need to be particularly evil to make that happen. Eugene Kim from Business Insider reported in August 2020 (emphasis mine):

On Tuesday, Amazon told its third-party merchants that they must meet certain delivery requirements — or else lose the coveted Prime label next to their products. These include Saturday deliveries and adherence to new one- or two-day delivery metrics.

The email was directed at sellers who have their own warehouse and use UPS, FedEx, the US Postal Service, or other carriers to deliver online orders in a program called Seller Fulfilled Prime. According to the email, fewer than 16% of products sent through Seller Fulfilled Prime meets the retailer's two-day delivery promise.

Several options exist for Amazon sellers to deliver their products. But the most popular is Fulfillment by Amazon, in which the massive retailer stores, picks, packages, and ships third-party merchants' wares in its in-house logistics network.

That means 84% of parcels outside of owned Amazon facilities are not in compliance with Amazon’s standards, waiting to be booted off Prime -if not the marketplace - at any time. That is a precarious existence for any third-party seller.

Seller Fulfilled Prime (SFP) is known also as FBM (Fulfilled by Merchant — as opposed to Fulfilled by Amazon (FBA)), and while only estimated to cover a smaller percentage of Prime volume, these services - which are operated by independent companies - received a huge boost during COVID as Amazon decided to ship only essential products through FBA - forcing many sellers to other facilities.

In a twist of competitive fate, if Amazon started offering logistics services in the US only to FBM facilities, it would have a willing customer with a huge motivator — keeping their products from running afoul of any Amazon rules.

What else would exist right there? The first beachhead market for Amazon’s Logistics service. Motivated customers with no alternative. Even if this is not how it would play out, it puts a lot of control in the hands of one company while at the same time leaves few alternatives for a seller who wants to play by the rules.

Sellers want to sleep at night, so the easy decision is to give it all to Amazon: something that could easily backfire. Again, I’m not saying Amazon will use this as a lever to power its own Fulfillment Service, but even if it doesn’t try very hard, it will naturally happen anyway.

And with its continued growth rates and expansion, it would be silly for anyone to ignore Amazon’s investments in North American Logistics.

Next time,

- Rick

PS: I constantly write about Amazon, here are a few more articles for your queue.