May 26th, 2025: Rapid Fire Headline Update and Shopify Releases Its Summer Editions

The Watson Weekly podcast is sponsored by Mirakl

Because “Traditional eCommerce” Is Just Code for “Not Growing” It’s time to do better than the status quo. Join 450+ retailers who are scaling 6X faster with AI, automation, and a platform built for what’s next. Marketplace, dropship, and retail media at enterprise-grade scale. It's time to accelerate with Mirakl.

==

It’s May 26, 2025 and this is the Watson Weekly - your essential eCommerce Digest!

Today on our show:

Rapid Fire Headline Update

Shopify Releases Its Summer Editions

- and finally, The Investor Minute which contains 5 items this week from the world of venture capital, acquisitions, and IPOs.

==

To hear new episodes of the show every Monday morning, subscribe now at rmwcommerce.com/watsonweekly and wherever you get your podcasts.

==

[PAUSE]

BUT FIRST in our shopping cart full of news….

Rapid Fire Headline Update

There’s so much news happening this week, I felt like I wouldn’t be serving you well to only serve up 4 stories. So I thought I would wrap 6 stories in one here, and spend some more time deep-dive on just one topic in a minute here.

In AI there are a few key updates

Open AI just bought Johnny Ive’s design startup for $6.5 billion. I guess that means OpenAI is getting into hardware. If you ask me, OpenAI smells blood in the water with Apple being essentially nowhere on AI. Would Jonny help destroy the company he built, or is this something different?

Instacart CEO Fidji Simo will run applications. Jonny Ive will now be the company’s creative head. These are not cheap hires. OpenAI has a plan to be one of the top 4-5 companies in the world, in the league of Microsoft, Google, Apple, Amazon, and oh yeah, NVidia. Let’s see what they are planning to get there to take advantage of their first-mover status with consumers.

Speaking of AI, Google just released its own Shop with AI mode for Gemini at Google I/O. Some of the features include price tracking and agentic checkout. Speaking of, isn’t this the same thing Paypal said it would try to do not long ago? Also, who doesn’t have agentic checkout? Should Shop Pay and Stripe be worried?

In Retail we have two updates from Nike.

One, is that Nike is planning on raising prices on some of its shoes due to tariffs, as soon as this week. Both Nike and Walmart have signaled that tariffs are too much to bear without making consumers pay some of the cost. Home Depot has taken the opposite approach, and has indicated that they will not raise prices. Experts seem to think that Home Depot will reduce its selection likely of items that would be unprofitable to avoid having to raise prices on other things.

The second piece of Nike news is that Nike is returning to Amazon! This is the first time that Nike is returning to Amazon since 2019. Ironically John Donahoe the former CEO of eBay was the one to take Nike off Amazon. Sounds like a terrible idea to not be where consumers are, at least to control your brand. To me, this sounds like a win for both companies: Nike and Amazon.

In other retail news, Walmart just announced it was laying off 1,500 workers to simplify operations. It seems to me that middle management is essentially a dying skillset.

Our final bit of retail news comes froM Shark Ninja which abruptly announced it is shifting all manufacturing from China. Almost 90% will be moved in just the next month or two. That is seriously fast. I expect the company would have gone bankrupt without this change with how fast this happened.

In software, we have a few updates.

Commercetools recently partnered with Optimizely to support their personalization and optimization solutions. Is this a signal that Optimizely is de-emphasizing Episerver? Or is it more that Commercetools needs a more sophisticated set of front-end services that are built in for its merchants

Separately, Commercetools also released its own MCP server this week, ironically on the same day at Shopify’s update.

Finally, there are a few eCommerce updates.

TikTok seems to have told many of its eCommerce staff to stay home this week in preparation for layoffs. What’s going on at the Tok?

[References:]

Our Second Story

Shopify Releases Its Horizons Summer Editions Update

Overview

Shopify released a number of updates in what they term their Horizon release, they mention over 150+. I believe it as the list keeps going on and on. Although all is not rosy, there is a lot to like in various areas. Note, this is not intended to be comprehensive. If you want to read the full updates, check the resources at the end.

Horizon Design System

Do we have a CMS in the making? Liquid takes a leap.

You have to start here because it gets the most emphasis from Shopify, after all the name of the release. So, what's Horizon? In my mind, Horizon becomes essentially a "commerce-first CMS."

A New Foundation for Liquid based on Theme Blocks.

10 new Themes were built to work with custom AI block generation (which generate custom Liquid code).

Introduces theme blocks with 30 components you can customize.

Drag and drop anywhere, plus preview blocks.

Analysis:

It strikes me that a lot of these theme-building features will be used by design agencies and not brands directly, but that doesn't really matter so much. If the system integrator is not recommending a separate CMS, it's a win for Shopify's own ecosystem. (Because a separate CMS would need its own front-end component library outside of Shopify's App Store, which would be Bad News Bears for Shopify).

The bar for system integrators keeps going up. AI prompts to generate entire themes or pretty customizable blocks, even interactive imagery, sections, etc. Brand expectations for design firms pricing keeps heading south.

Recently, I found a lot of system integrators pivoting into design services as a hedge against falling Shopify developer prices. In response to potentially falling design prices, I do expect that conversion rate improvement services as well as lifecycle marketing will get more attention as design itself gets even more commoditized by AI.

Bottom Line: It strikes me that the Shopify front-end is the right there next to "Best Checkout" at the core of the Shopify message against other platforms. Can you use Liquid vs a Headless CMS? Shopify trying to say you ain't going to need it.

POS v10

Playing catch-up, but with the advantage of a Unified Design

Shopify seemed to want a direct fight with Salesforce, and they got it. If there is one thing that Shopify has done in the last two years, it's push the message that POS and Commerce platform need to be one. Err... Unified. In my mind, it prompted responses from both Salesforce and commercetools.

Notable Updates:

POS gets a redesigned UX, including better branding and search.

Ship and Carry-out functionality in the same order -- meaning essentially split shipment-type support in POS.

Bottom Line: There are still a lot of gaps in Shopify's Unified Commerce messaging here. Products like NewStore and PredictSpring while expensive are still in a very different class. Even Shopify's "friendly" partner Manhattan Associates (seen presenting with Shopify at Shoptalk) has their own Enterprise POS, paired with the real OMS.

Sidekick

Side-Kicked into high gear?

It's taken a little bit for Shopify to invest more into Sidekick and for it to truly see the light of day, but I think we will mark 2025 as the year Sidekick truly arrived.

Notable Updates:

Wants to be your "AI Co-Founder" for your eCommerce business. Evolving from assistant into a helpful business partner. Ask it anything, even about strategy. It will give you options and show you how to do it.

Fully integrated into the Shopify admin.

Added image generation too.

Screen-sharing and call with an AI representative who will walk you through things to help you out. Support is a key Sidekick use case. Business improvement (strategy/conversion, etc) is another key one.

Analysis:

There's that "co-founder" message again. Entrepreneur much? It's not a slight, but Shopify's real focus shows up again, and again, and again. It might seem like criticism, it is simply consistent observation.

Simple CRO agencies beware. Sidekick is coming for your lunch money.

The demo shows that it will even proactively suggest you run a coupon to further lower your margins! How clever!

It seems like a straightforward that Sidekick itself will become a data marketplace calling into other MCP servers provided by third-parties. Another ecosystem is born? Will Shopify allow developers to monetize and how?

It's safe to say you have seen the last Shopify support representative ever hired.

Bottom Line: I do expect Sidekick to be particularly important for Shopify's future vision. That said, it's hard to tell if this will differentiate them in the long-run since most platforms will have an equivalent.

Shop App

Why do I need a real-time discovery engine?

Notable Updates:

A new description for what Shop App is: "A real-time discovery engine." (True Story)

Some collection-saving features.

Better recommendations

I fell asleep...

Analysis:

Honestly, until they fix Shop Cash expiration this place is dead to me.

What's a real-time discovery engine, anyway? Is that an LLM? We already have like 10 of those.

Bottom Line: In the end, Shop App is still like a marketplace, except you are helping Shopify bootstrap. Whereas a real marketplace already has the customers you want, they just cost something to acquire. Sign me up for the latter. If I want an owned channel, I want to really own it. This perpetual in-between state is frustrating. I understand tinkering, 100 year company, yada yada, but let's get on with it... Enough with the yada.

Enterprise

The Milk Carton Awards this release goes to the Enterprise Team. There is an Enterprise Dev Team, Right? Right?

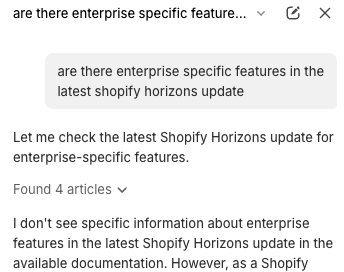

Ruh-roh. Not seeing any Enterprise-specific updates in the release, I asked our trusty recently upgraded advanced reasoning Sidekick. Surely I missed it.

Nope. Here is a screenshot of my Sidekick chat.

Sidekick Enterprise 404

Analysis:

Even Sidekick couldn't find it.

Even if you agree with the fact that Shopify is in the progress of making major Enterprise progress with Markets, Legal Entities, blah blah (debatable)... Shopify is still in major need of better Enterprise STORYTELLING.

Bottom Line: 🆘 Send help to Bobby. 🆘 Message in a bottle. 🆘 Hell, send Sting. 🆘 Shopify is always always always going to tell the entrepreneur story first, second and third. Which leaves Enterprise... well, not in the top 3.

Next-Generation Dev Platform

Developers, Developers, Developers...

Notable Updates:

Ability to create code/object definitions and deploy to all the stores that you are associated with.

Polaris components usable across admin, client UI, POS.

New Dev MCP Server to custom create code for you.

New App Dashboard for analytics.

Streamlined and Updated Built for Shopify Design Requirements.

Improved App Recommendations for Large Merchants.

Analysis:

The “Simplified” Built for Shopify Design requirements have 24 subsections and 85 detailed requirements. These are the "simplified requirements."

App recommendations for large merchants is a bit opaque. There is so much more to be done here, and it doesn't seem like: (a) Shopify means "Enterprise" here, and (b) Shopify is really giving this experience too much oxygen.

Bottom Line: A sneaky important priority for Shopify is a best-in-class app ecosystem. Of course the number of Shopify stores is a key reason that apps target Shopify. But a close second is a best in class (from a commerce point of view) Shopify App Store, build environment and tooling for developers that most do not even contemplate at this level.

Markets

A year ago, Shopify promised One Store to rule them all, and the way to localize for various sub-geographies and locales was going to be called Markets. Well, here we are and there we went. There are a lot of things we are still waiting for.

Notable Updates:

Ability to operate multiple entities from a single store.

This sounds great, until you realize, this feature does not really seem done.

Notable Limitations:

If a primary entity is using a third-party payment processor, then you can't add Shopify Payments to your secondary entity.

You can offer subscription orders when you're selling from multiple entities with Shopify Payments, but all subscription payments are processed through your primary entity (which hits FX fees). So what are the other entities for if you have a subscription business?

Additional third-party payment methods are only displayed on checkouts and for markets associated with the primary entity, with the exception of PayPal.

None of this works if you are using Managed Markets.

Permissions can't be assigned for different markets, even if each market is managed by different teams.

Only one theme can exist in your entire Store, regardless of if different markets are managed by different teams. You can customize themes per market, but it feels like a big limitation.

Several of these feel like quite large gaps.

Bottom Line: Feels like they are knocking down use cases like a game of whack-a-mole. They seem to be trying to drive a stake through the heart of Managed Markets. But it's taking some time. They seem to be very focused on the idea of entities, and not so focused on when to use a Merchant of Record / Seller of Record model versus creating and managing your own entity. Is more expertise needed here? Europe is growing fast so it's possible I'm missing something.

B2B

Not advancing nearly fast enough...

Notable Updates:

Markets are now available.

Min and Max order limits for all customers possible.

Gift Card support.

Automated Netsuite Connector support.

Analysis:

Markets for B2B still a "Test Drive". I'm sorry, a Test Drive?

Order limits not nearly flexible enough to be usable. Feels like something Checkout Blocks gave them almost for free and now they are just talking about it.

It strikes me there are two types of ERP connectors in the world. Broken ones, and customized ones. Out of the box automated ERP connectors rarely deliver what they promise simply due to the fact that the ERP itself is so customized.

Gift Cards in B2B, what are we even doing here?

It strikes me that Shopify is currently getting more "at-bats" in B2B than it deserves based on the product. "Fake it until you make it" I find is being subsidized by system integrators. A somewhat dangerous place to be in large accounts.

Bottom Line: While this is a market that Shopify has started talking about more, the innovation has not yet revealed itself. B2B is an extremely competitive market. And while in B2C you could say that Shopify has pulled ahead of the market and is accelerating, I would say the broader B2B platform ecosystem is innovating faster than Shopify.

Conclusion

I tried to summarize a lot here, but Shopify also left quite a number of limitations beneath the sheets unsaid.

And beneath these sheets -- somewhere trapped in between legal entities, catalog and sharing, geographies, payments, permissions, and markets -- is the foundation of a platform that is just not designed from the beginning for what they are pushing it to do. And in the upper mid-market/Enterprise, those limitations do show up.

It strikes me that the only way to resolve these concerns will be quite a few more Boring updates in the future.

Shopify is customizable, so if the current box is good enough and you can customize or upgrade with apps (off-the-shelf or custom) some of the rough bits for your own purposes, is it good enough for you?

This is another way of writing a similar question:

Has Shopify Got Too Many Damn ICPs?

My friends, the story is still being written

[References:]

https://www.linkedin.com/pulse/shopify-horizon-big-design-leaps-enterprise-milk-carton-rick-watson-naple/?trackingId=R8zIGwARSticA6J085nDDQ%3D%3D

It’s That Time Friends, for our Investor Minute. We have 5 items on the menu today.

First

Harry’s Rebrands To Mammoth Brands

Harry's was supposed to exit to Edgewell, owner of Schick and Wilkinson Sword brands, for $1.37 billion, but it was blocked due to antitrust grounds. Six years later, the razor brand Harry's has rebranded to become Mammoth Brands, a holding company of several personal care brands. This new entity, which has generated $835 million in revenue, will continue acquiring and scaling brands. Does this mean more personal care brands or consumer packaged goods brands, and how will this be funded?

Link: https://www.nytimes.com/2025/04/09/business/dealbook/harrys-mammoth-consumer-goods-deals.html

Second

Frank and Oak Accelerates Closure of US Operations

Frank and Oak, a Canadian apparel brand, closed their US operations at the end of April due to the customs and tariff changes. Interesting to note that in the last week of April, news broke in Canada that the company was closing all of its retail stores, selling its intellectual property, and filing for bankruptcy. April was uncertain, but Frank and Oak clearly had bigger issues than cross-border business challenges.

Third

UPS to Acquire Andlauer Healthcare Group for $1.6B

UPS has announced that it will acquire Canadian-headquartered Andlauer Healthcare Group for $39.62 per share in cash at a purchase price of $1.6 billion. UPS gains additional end-to-end cold chain services for healthcare customers, including facilities in Canada and trucking subsidiaries in the US. UPS wants to be the de facto logistics partner for the healthcare sector, but also take a share in the growing demand and higher margins in the healthcare sector versus normal deliveries.

Fourth

H&M Group Makes Minority Investment in Centra

Centra, a vertical-specific e-commerce platform, has announced that H&M Group has invested in a minority stake. The minority stake, less than 10 per cent, values Centra at just over half a billion Swedish kronor or just over $50M at current exchange rates. The new funding will be invested in growth and product development. In 2024, various H&M-owned brands transitioned to utilize Centra to leverage fashion-specific solutions. Is this confirmation bias or the road to a possible acquisition?

Link: https://centra.com/news/hm-invests-in-centra

AND FINALLY …

Channable Acquires Europe's Largest Google Shopping Partner Producthero

European e-commerce data feed platform Channable has announced that it has acquired Producthero, a Google Shopping partner, for an undisclosed amount. The acquisition enables Channable to strengthen its feed management and PPC optimisation capabilities, and enables Producthero to widen its services away from being Google Shopping-centric. Channable acquired WakeupData in 2024, which had similarities with Producthero. Who would have thought that feed management and comparison shopping engines is still a thing in 2025?

[PAUSE]

Did you know that RMW Commerce has another podcast? Check out The Watson Weekend for an unfiltered and lively eCommerce chat each week with me, Rick Watson, my co-host Jess Lesesky, and an array of interesting guests and topics. All focused on eCommerce. You can find the Watson Weekend by searching for it on iTunes, Spotify, or Youtube.

That’s all for this week! Till next time Watsonians.....

[PAUSE]

Hi, I’m Rick Watson, CEO and Founder of RMW Commerce Consulting and host of the Watson Weekly podcast - your essential eCommerce Digest.

Our production partner for the series is Podcast on the Fly. This podcast is produced by RMW Commerce.

To hear new episodes of the show every Monday morning, subscribe now at rmwcommerce.com/watsonweekly and wherever you get your podcasts.