What if Shein is the Amazon Competitor We Have Been Waiting For?

The Rising Competitor Challenging Amazon's Dominance

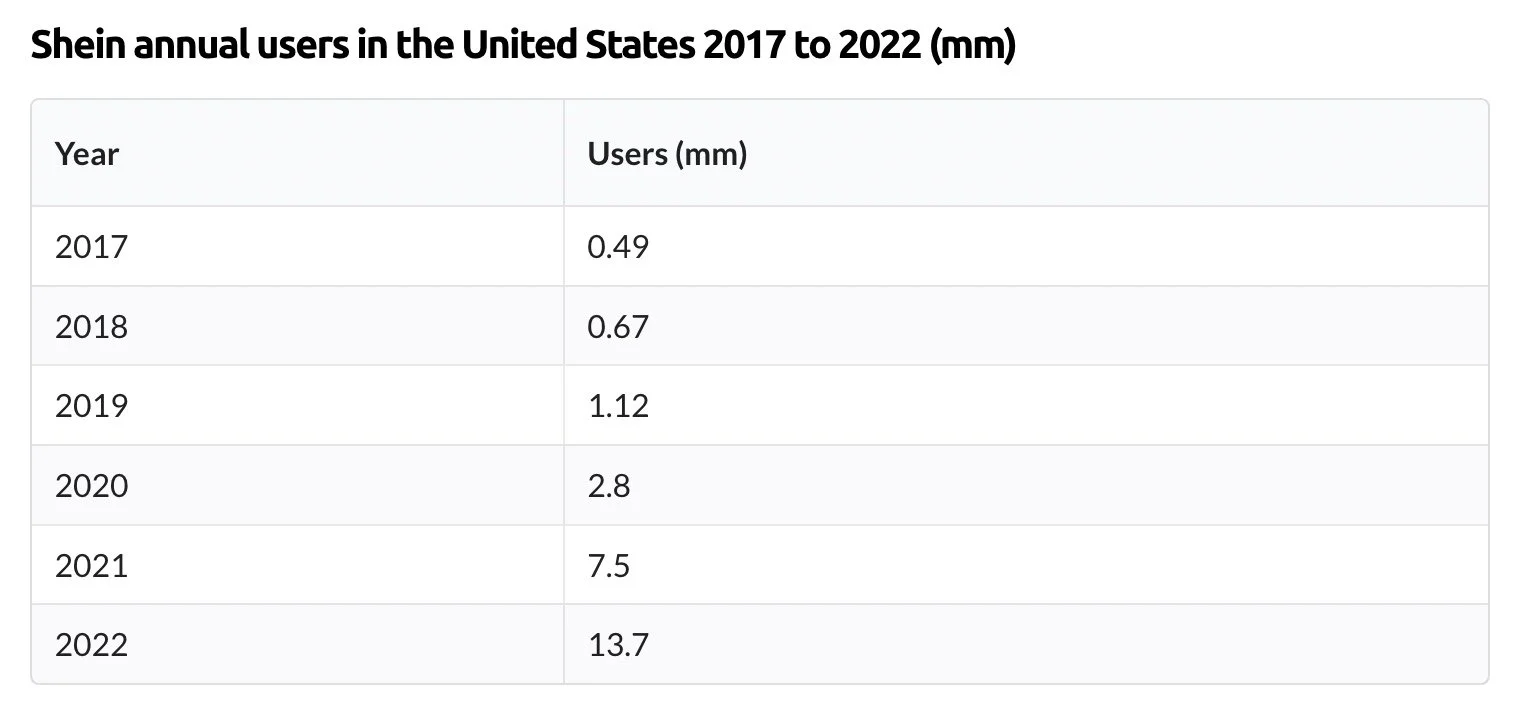

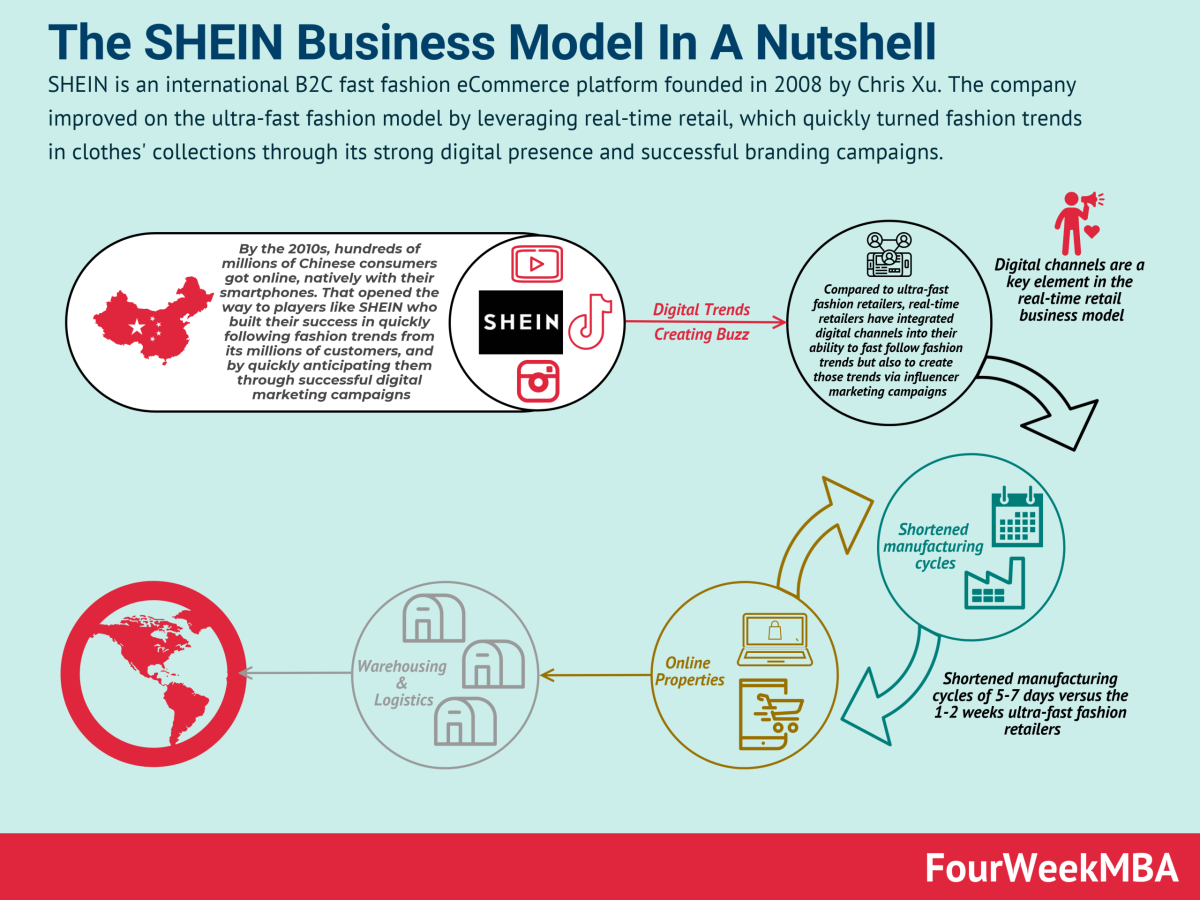

In the fiercely competitive world of e-commerce, an unlikely competitor has emerged, and it hails from China. Shein, a native Chinese marketplace focused on fast-fashion, is making waves as it thrives in the United States market. While numerous contenders have attempted to dethrone Amazon in the past, Shein possesses distinct advantages that position it as a potential game-changer. This article explores the key factors that contribute to Shein's disruptive potential, highlighting its prowess in data-driven decision-making, supply chain optimization, improved shipping capabilities, and the strategic implementation of a thriving marketplace. As Shein gains momentum, it presents an intriguing alternative universe, offering an extensive range of affordable and diverse products that were once synonymous with Amazon. Join us as we delve into the rise of Shein and its potential impact on the e-commerce landscape.

Shein’s Approach to Data and Consumer Trends

Shein has always been a data-first company. They know social consumer trends and test and learn (and perhaps rip off) faster than anyone.

Shein Excels in the Supply Chain

While shipping is not fast, the supply chain is more than just about shipping; it's about the length of time from trend to inventory availability. And no one beats Shein at their volume on this metric.

The Significance of Improved Shipping from China for Shein

Another supply chain item. Holding global inventory in one region rather than scattered all over the world is helpful to Shein, which is a huge cost avoided. And the time to the doorstep from China directly will keep dropping. I have seen global 3PLs in China claiming eight days to the doorstep with standard shipping. It's starting to get compelling, given the global pool of inventory advantages.

If consumers don't need the item in 5 days or less, "Why hold the inventory in the United States?" is a question many retailers will start asking.

How does Shein leverage its marketplace for growth?

Long the secret of Amazon, finally we have a company born in China that can learn from and steal the real secret of Amazon's growth in the past 10 years: Chinese-born Amazon sellers. All it takes is liquidity.

And Shein already has that. That's what you need for a marketplace. Other places like Ali Express, etc haven't really made it to the US very well, but Temu and Shein are already on the trajectory.

Forget that Shein started in fashion -- once you get people coming to a site for "eventual shipping and very low prices" they will buy anything.

It's not clear that Amazon's traditional "faster shipping, more selection" playbook can blunt the rise of Shein because Shein's supply chain is optimized for the "slower shipping, more selection, lower prices" use case.

Even if Shein doesn't topple Amazon, it could create a huge alternative universe of -- cheap, diverse items you used to get at Amazon, you can get cheaper but not faster at Shein.

10 years ago I saw many (VC-backed, naturally) eCommerce startups claiming that "expert curation was the missing ingredient in retail." We have put the nail in that coffin long ago -- no curated startup has even dented Amazon.

It takes selection, and it takes supply chain. Many players have been missing the second. All of my above points play into a Shein supply chain advantage.

While Amazon isn't going anywhere for a while, we may have the first compelling alternative in a generation in Temu and Shein.

Expert Consulting: How Will You Grow Your eCommerce Company?

When growth is elusive, I am an expert at asking incisive questions to surface the real issues and then present straightforward ideas that your team can actually implement.

Mistakes are expensive. They cost money, of course. What’s worse is the opportunity cost. I work with investors and management teams worldwide to help them get a handle on their digital business plans to execute a clear path forward.

For more on marketplaces, you might also like: