What are the Top 3 Questions Shopify Must Answer in 2023?

Well, it's 2023. Time to ask the tough questions of Shopify, here are mine:

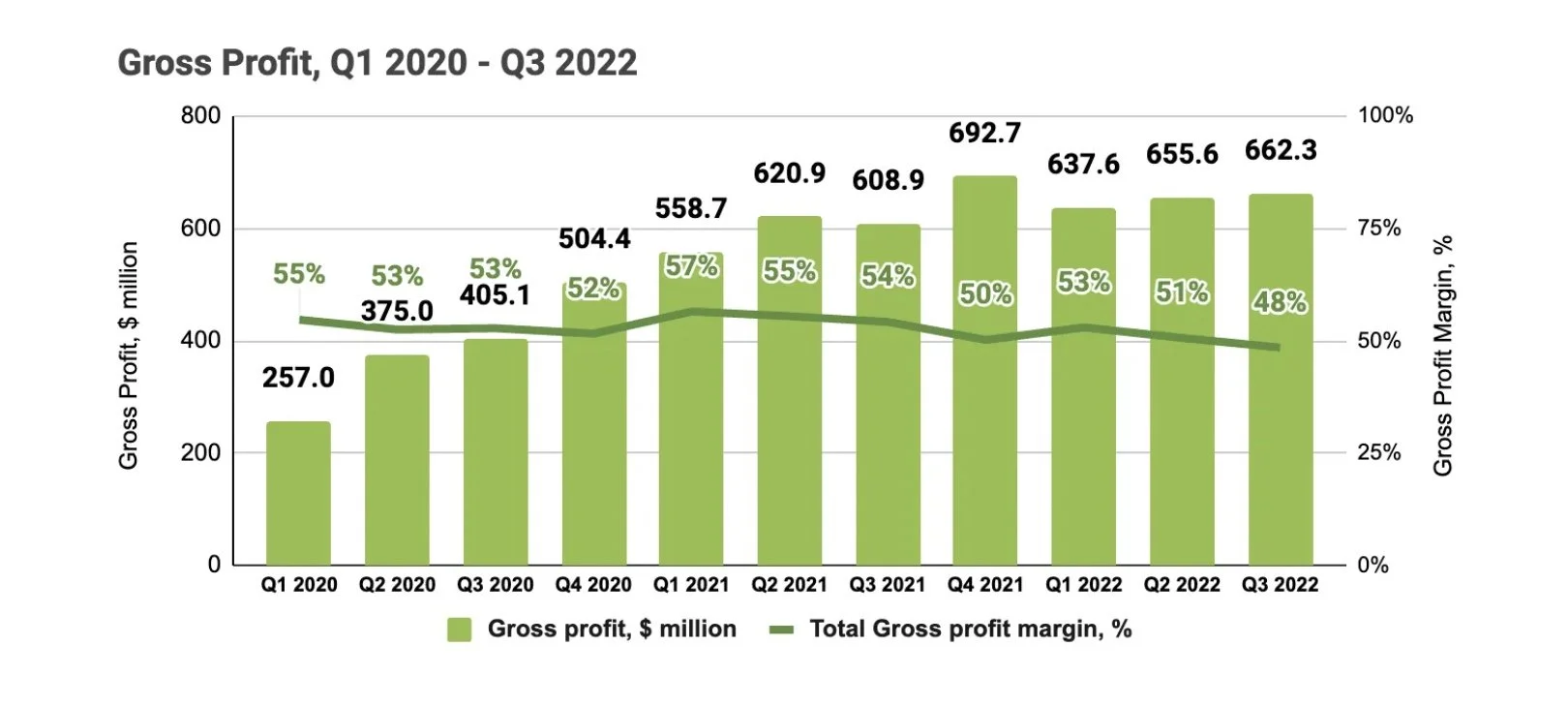

Can Shopify Reverse Its Gross Margin Declines?

Shopify has steadily moved lower in gross margins from its mainstream product, to Plus (payments), to Fulfillment.

Slower growing Subscription Solutions is ~80% gross margins. This is typical software gross margins.

Source: Popular Fintech

Faster growing Merchant Solutions (Payments/Capital,etc) is ~40% gross margins. This is typical retailer gross margins.

Fulfillment is likely 20% or less Gross Margins, but they would never break this out soon.

How is this a good trend?

I've said more than once that while Shopify invests in advertising, it's not focusing nearly enough. You might even say that instead of investing in fulfillment in 2019, it should have picked advertising. Huge miss.

In truth, this question is tricky. An easier question in the short term is, what are Shopify's options?

- Raise its subscription prices (this is coming).

- Buy a payment company so that it can ultimately replace Stripe and gain more gross margin per transaction. (this should be coming).

Can Shopify's Fulfillment Strategy Demonstrate Meaningful Results?

In 2019, Shopify acquired 6 River Systems and launched Shopify Fulfillment Network. In May 2022, Shopify acquired Deliverr for $2.1B.

Analysts want Fulfillment to approach a meaningful % of GMV. Analysts are kidding themselves. Shopify's fulfillment solution is for entrepreneurs, not big brands. The right metric is % of accounts -- it would match their go-to-market strategy.

If Shopify can get 3-5% of accounts on one of its Fulfillment solutions this year (by which I mean Deliverr, SFN). (To be clear, they would get hammered by analysts for stating this goal. ) [I want to be clear I'm not talking about label APIs]

If Shopify's "top priority" (vertically integrated logistics) can't generate even this kind of muted progress, it's safe to actively question if they will try and sell this asset off in 2024 as the market improves.

Can Shopify shift the narrative from entrepreneurs to more up-market?

If you haven't noticed, a few things happened in last 6 months. Shopify released Commerce Components, signaling its intention to sell into Enterprise retail. Shopify Plus became the lion's share of growth, and Tobi recently admitted he was trying to drag the company to the next box.

I was slightly surprised by Tobi's use of the word "drag" here, but I don't want to overstate its importance. It likely meant "what got you here (entrepreneurs) won't get you there (up-market)." Which would be true.

Shopify must change many things about itself to get better at selling a range of components to businesses of all sizes, instead of just being the best platform for entrepreneurs and new businesses.

But to do that, Shopify would need to stop saying that "2023 is the year of the entrepreneur" -- and instead focus up-market.