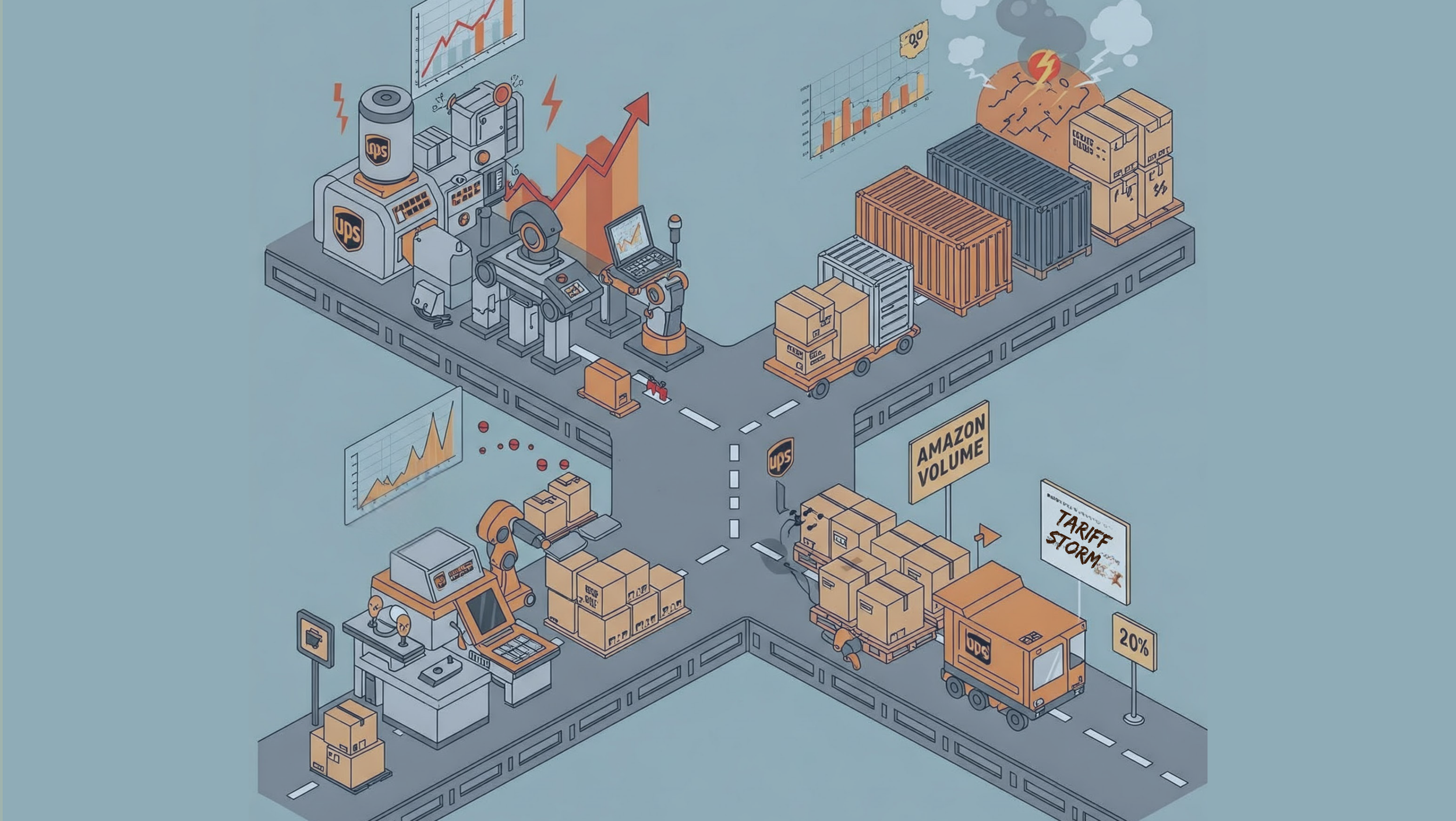

UPS Q1 Earnings: Amazon Volume Decline Prompting Big Ch-Ch-Ch-Changes

Summary of UPS in 2025: Make Changes Quickly. Hope for the Best, But Plan For the Worst Too.

1 - Tariffs will hit SMBs faster than anyone else (have not been hearing this)

Most SMB customers are single-sourced from China.

SMB are trying to reconfigure, but large customers have first-crack at new manufacturers.

Large customers also have the capital to pull inventory forward to beat tariffs, SMBs do not. UPS says "open question" how large companies respond to tariffs (price increase, push to suppliers, etc)

Already seeing big growth increases from Europe, Vietnam, and Thailand inbound into US as manufacturing volume shifts.

Tariffs are causing customers to sell-off inventory rather than re-order; inventory levels could decline this year after increasing last year.

UPS is getting a tariff "triple-whammy" that they are trying to manage:

China to US is most profitable trading lane.

SMB customers are growing the fastest for UPS (DAP revenue grew 24% y/y)

SMB customers are some of the most profitable customers for UPS (and represent 31% of volume, highest number ever)

All told, import volume is only 2% of total global daily volume so exposure is not the worst. Also UPS considers the consumer "pretty healthy"

2 - UPS aggressively reconfiguring its network to deal with Amazon ramp-down

60% of the Amazon volume disappearing is not profitable.

Will remove $3.5 billion in expense this year related to this.

Closed 11 buildings in all of 2024. Will close almost 7x (73 buildings) this by end of Q2!

Decline in average daily volume for Feb/March was higher than expected.

Planning aggressive US domestic margin expansion from 7% today to 9.3% by end of Q2, to more than 12% by end of 2026. Price increases and automation hey-o!

All told, UPS is working through a number of scenarios. Lessons for your business?

Talk to your customers. Understand their plans.

Talk to your suppliers. Ask for their help with your biggest problems. Call a summit about it.

Plan a range of scenarios from "as dark as we can" to "the most optimistic as we can."

While UPS always publishes ranges, you never hear UPS speaking in such uncertain terms about the future. That itself is notable and should be a lesson for us all.

Expert Consulting: How Will You Grow Your eCommerce Company?

When growth is elusive, I am an expert at asking incisive questions to surface the real issues and then present straightforward ideas that your team can actually implement.

Mistakes are expensive. They cost money, of course. What’s worse is the opportunity cost. I work with investors and management teams worldwide to help them get a handle on their digital business plans to execute a clear path forward.

For more on Supply Chain, you might also like: