How Does Shopify Work With Amazon Buy With Prime?

This article attempts to unpack all the mystery surrounding Buy With Prime and Shopify’s current stance on it.

Here are a few of the questions we will answer in this article:

Why did Amazon Introduce Buy With Prime?

What are the Benefits of Buy With Prime for Retailers and Brands?

Why Are Buy With Prime and Shopify Potentially On A Collision Course?

What Did Shopify Initially Say About Buy With Prime?

What is Shopify’s Current Policy Towards Amazon Buy With Prime?

Why Might Shopify Be Interested in Banning Buy With Prime?

Why Might Shopify Want to Partner with Amazon’s Buy With Prime?

What is Shopify Likely To Do Next with Buy With Prime?

How Do you Install Buy With Prime on my eCommerce Store?

Where Can I Go For Expert eCommerce Consulting on Buy With Prime?

Why Did Amazon Introduce Buy With Prime?

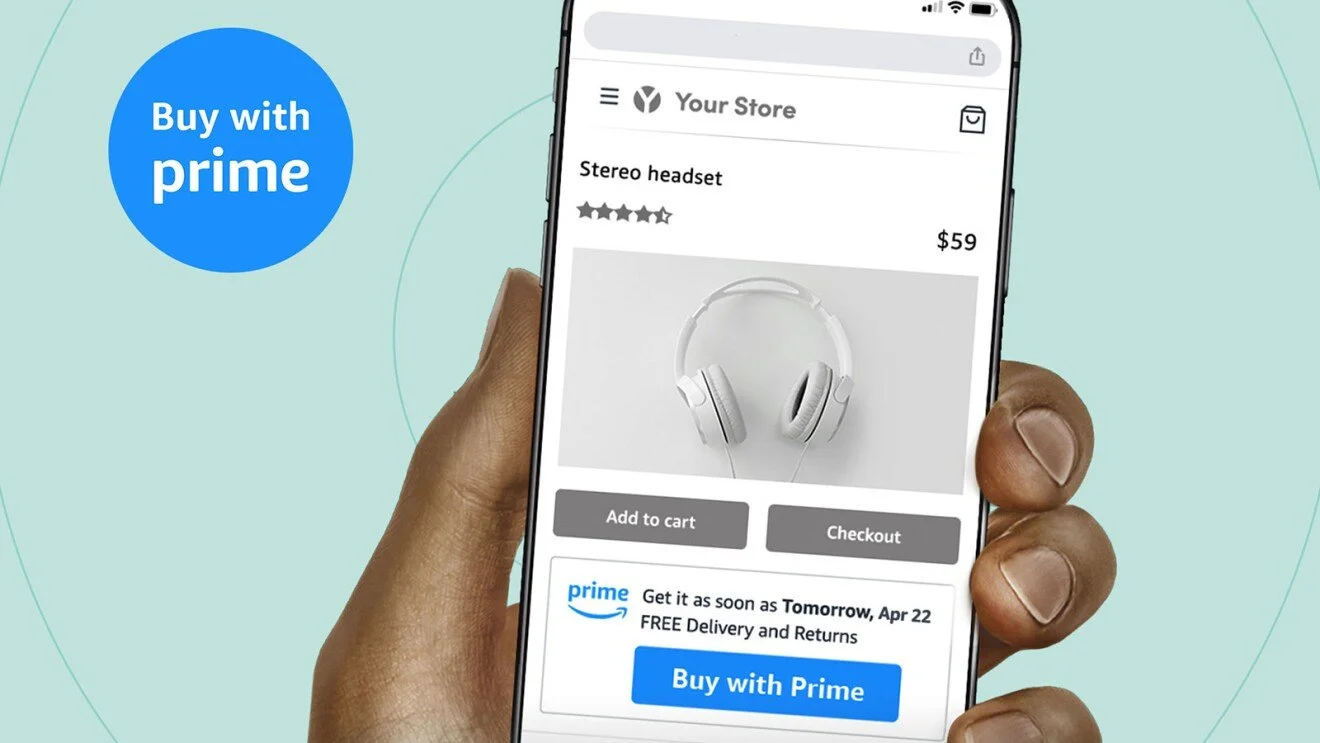

Amazon introduced Buy With Prime as a way for shoppers and merchants to extend their Prime benefits to their own online stores. This increases the value of a Prime membership by offering fast, free shipping, a seamless checkout experience, and free returns to participating merchants. Initially, Buy With Prime was an invitation only platform for merchants using Fulfillment by Amazon (FBA).

In terms of features, while Amazon Buy With Prime just launched, it's different from most other "features" or plugins. More so than Amazon Pay (just a button), Buy With Prime is a hook into Amazon's marketing, payments, and fulfillment ecosystem.

There is still some question to be answered regarding how Amazon can take full advantage of Buy With Prime. You need more than just a few benefits to attract merchants -- you need what's called a "burning platform." Read more about my thoughts on Amazon’s Buy With Prime announcement here.

Amazon used to have a program called Amazon Webstores. This program has been sunset years ago, and Amazon is now back for another bite at the apple. This time, it decided it does not want to provide the entire storefront. Instead, it is just providing payment and fulfillment services for brands.

What are the Benefits of Buy With Prime for Retailers and Brands?

Better Customer Experiences

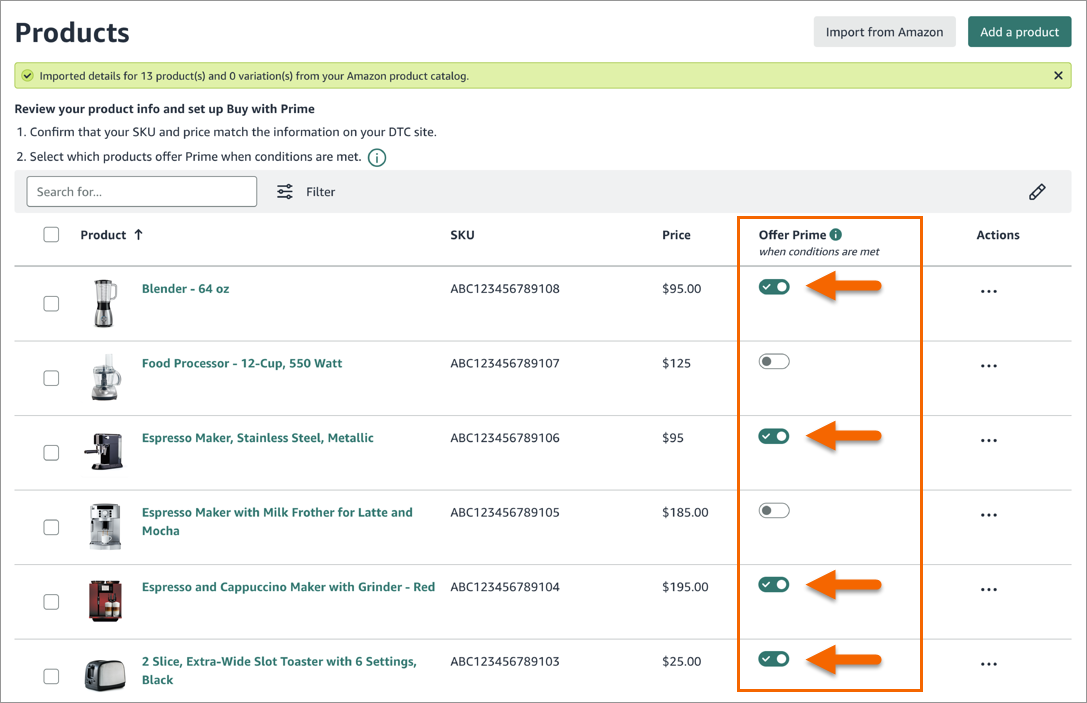

Retailers and Brands are promised a better customer experience with the extension of Prime benefits to merchants. BWP enables sellers to showcase their offering of Prime shopping benefits on their own direct to consumer site—including fast free delivery; a seamless checkout experience; and free returns on eligible orders. Since Buy With Prime is no longer limited to just Amazon, merchants are able to convert customers into their own customers.

Generating More Revenue From Online Shoppers

Amazon recently released data that shows that Amazon Buy With Prime increases conversion rates by 25%. If your website converts higher, than you will definitely generate more revenue on your eCommerce store if this is true.

Establishing Loyal Customers

Crowning the Prime logo with the Amazon Prime trademark is a great way to increase the loyalty of your customers. Shoppers who frequent Amazon stores get familiar with Prime logos alongside their products, and buy with prime allows retailers to tap into Amazon's 200,000 loyal customers. Participating retailers can access the email addresses of customers so they can establish a personal contact by delivering promotional emails.

Ultimately, Buy With Prime offers merchants the chance to elevate their own stores with assets they wouldn’t otherwise have.

What Did Shopify Initially Say About Buy With Prime?

A recent interview with Shopify's Logistics CEO highlights the shifting position of Shopify towards Amazon.

Here are a few points I took away from the interview:

Aaron Brown says that the company is actively working with Amazon and is "super excited" about what Amazon is doing. Oh Really? Shopify loves the fact that Amazon is trying to introduce the Prime brand to Shopify merchants and cut Shop Pay out of the loop entirely? (no likely that is not what he is talking about -- more likely, their collaboration on the Deliverr side of the business, but this is not a piece intended to make waves with Amazon)

With the purchase of Deliverr, they acquired functionality that directly works with Amazon in ways that their merchants depend on. How?

In two ways:

Amazon Prep.

Amazon's warehouses - like any - have particular standards whereby if you don't follow them you are charged both in money as well as processing time (accuracy too) if you don't conform to Amazon's standards.

Merchant-fulfilled Amazon parcels.

This includes just regular Amazon fulfillment (not Prime) as well as Merchant-Fulfilled Prime.

Why Are Buy With Prime and Shopify Potentially On A Collision Course?

So Shopify at this point is "committed" to support Amazon as a channel, and is acknowledging that fact. Does this mean Shopify will bring back its native Amazon Connector. What would be the logic behind supporting a BS eCommerce channel like Twitter and not your new bestie partner Amazon? (who incidentally controls the bulk of North American eCommerce).

According to Aaron Brown, "Amazon and Shopify are trying to solve different problems".

I think this was true frankly prior to the launch of Buy With Prime. Amazon is in no uncertain terms attempting to drink Shopify's milkshake here, and the CEO of Shopify Logistics should probably at least acknowledge that.

I predict that Shopify agencies are going to have a choice to make soon.

What is a Shopify agency?

These are the companies that design and build Shopify websites for brands. They are often companies that have to work with dozens, even hundreds of partners to accommodate all the customer experience, data, and other requests for their brand customers.

What are the flashpoints in the coming battles between Shopify & Amazon?

I'm sure Shopify doesn't like the fact that Buy With Prime bypasses Shopify Checkout altogether (something that Shopify banned with Bolt, Fast and others).

Shopify could let Amazon BWP integrate with the Shopify Cart natively -- similar to Amazon Pay -- This would likely remove the "Buy Now" button on the Product Detail page, but probably not Amazon's Prime marketing banner -- that's super-important to Amazon.

Shopify - who has a very tight leash on its Shopify Plus and other agency partners for leads, etc. - could add new terms of service to agencies to prevent them from integrating Buy With Prime. Would they do that? Unclear. But I'm sure they are considering it seriously at the moment. Agencies that know, know that being on Shopify's bad side is not a ton of fun.

The agencies that work with Buy With Prime will likely have to learn how to do new things, like integrate Amazon's advertising program, and there are many that are really just theme and app-focused. If BuyWithPrime takes off, these agencies will need to learn how to adapt, or see brands take this business elsewhere to another specialized agency who will handle just this part. (To be fair, this does happen in the Shopify world today where some agencies focus more on back-office than front-end which I would say is more cutthroat).

I predict that other platforms like WooCommerce and BigCommerce will embrace BuyWithPrime with open arms. Setting up a number of comparison points for these companies. Particular for brands with > 50% Amazon volume, and use FBA today.

Deliverr vs FBA. Well, this one is not really any kind of serious fight in terms of reach and capabilities. One company spends tens of billions a year in logistics, the other just bought a software company for $2.3B. BUT the fight is more philosophical. With a $2.1B investment in Deliverr, will Shopify really allow people to use FBA to fulfill if it's attached to Prime, or will it be more limited to how 3PLs worked before Shopify Fulfillment Network?

Why Might Shopify Be Interested in Banning Buy With Prime?

Should Shopify Go "Full Nuclear" with Amazon Buy With Prime By Using Its Full Flywheel Against Them?

There are a few historical parallels as to what is happening between Amazon and Shopify.

One is Macromedia Flash and Apple. In 2010 Steve Jobs released an open letter against Flash, calling it dangerous, closed, filled with security issues, and battery-draining.

All this is well and good, but wouldn't the market sort these reasons too? No, the ban was for a different reason. Quite simply, if developers built applications in Flash rather than for native Mac, it threatened the future of Apple. This worked.

Another is Microsoft and Linux. Linux had the community and cost advantage, particularly on the server side. Nothing Steve Ballmer could say could blunt the rise of Linux, no matter how many failed marketing campaigns they could come up with. Developers and IT departments simply had too much vested interest in an alternative. This did not work.

Satya Nadella formalized what was happening on the ground by eventually supporting Linux.

What would "Full Nuclear" Shopify look like? Does Shopify Have an Integration with Amazon?

Well, It would not look like a simple editor window warning (what we have now). That’s right, there is currently no integration at all between Shopify and Amazon.

First, it would require recognition that Amazon's BWP threatens the core of Shopify's business model (Payments GMV); at the same time, it threatens Shopify's biggest priority -- vertical logistics integration.

Amazon is bringing its Prime flywheel to bear against Shopify. Shopify must bring its full power against them -- anything less is a half-measure. And in an outright battle with Amazon, half-measures will not be enough.

Shopify's flywheel comes from two sources: developers and agencies. Essentially, the strength of Shopify is of course its great price-performance ratio, but also the strength of its ecosystem. More agencies and apps support it than anyone. It's the "default."

An opening salvo in this war would be simple -- if any agency wants any dollars from Shopify, it must choose sides and not implement Buy With Prime. If any developer wants investment dollars from Shopify, it must not develop apps for Amazon Buy With Prime.

In short, don't take the battle to merchants at all by warning them. Take the battle to the ecosystem. And the consequences must be real.

Shopify has always had that whole echo chamber situation going on with its ecosystem -- it's part of the reason for its success. Now Shopify must be clear to everyone who has the power in the ecosystem.

But Shopify must hurry - Amazon is training agencies to implement Buy With Prime.

Another way of saying this?

If Tobi Lutke does not act like Steve Jobs to Adobe now, he will act like Satya Nadella to Linux later.

Why Might Shopify Want to Partner with Amazon’s Buy With Prime?

I made the case that Shopify could go full nuclear with Amazon and what that might look like.

On the other hand, kicking sand in the face of a gorilla is perhaps not the best idea. We are not all Steve Jobs and Buy With Prime is still new and invite-only.

In the end, Shopify needs to embrace the fact that their merchants need to be in every channel they can. And if your primary eCommerce service provider gets too opinionated, it’s a risky proposition.

What might a partnership between Shopify and Amazon look like?

Amazon could get:

Native support for Prime badge in Shopify stores.

Amazon would get a Buy With Prime app in Shopify’s App Store. Of course this means Amazon would need to pay royalties to Shopify. I just laughed a little typing this.

Support for Amazon Advertising native in Shopify. Perhaps as a feature of Shopify Audiences.

On the other hand, Shopify could get:

Deliverr customers would automatically qualify for Prime badge — similar to what happens on Walmart.

Shop Pay added to Amazon’s native payment methods. (Ok this would be bananas but if Amazon wants full Prime support this would be the equivalent)

Shop Pay would be the default payment method for Buy With Prime. This could be one compromise. Amazon could keep its payment method but if the source is from a Shopify store, Amazon doesn’t try and fully hijack their checkout.

Could agree not to build their own competitive marketplace.

Not sure how much value this would have to Amazon?

What Is Shopify Likely To Do Next With Buy With Prime?

In either scenario, both sides would give up something they really don’t want to get something they really do want.

Of course there is another path. Which is to say the current one. However if you are going to really support merchants doing this, may as well partner as closely as you can. Or get what you can for it.

I get the sense the current path of Shopify showing a warning to merchants when they add Buy With Prime is a trial balloon based on internal compromise. The Buy With Prime program is not live so it’s risky to go nuclear and it’s likely Shopify sees Amazon play another card.

This is another way of saying Shopify hopes Amazon fails on its own and doesn’t have to confront Amazon directly. Or Tobi is true to his word and really does want to partner. So this thread might be useful :)

In any event the game here is: can Shopify launch and scale “Shop Promise” (details still light) and prove it faster than Amazon can do the same with Buy With Prime?

The most likely approach, in my opinion, is the wait and see approach. Shopify will take no action initially to avoid rocking the boat with Amazon.

How do I Install Buy With Prime On My eCommerce Store?

Buy With Prime can be installed by one of the recommended Buy With Prime Agencies. EquityCommerce is one of the best BigCommerce and Shopify Buy With Prime agencies.

Not to be left out, BigCommerce has also recently released an app for installing Buy With Prime more easily.

Where Can I Go For Expert eCommerce and Shopify Consulting Regarding Buy With Prime?

RMW Commerce offers services specializing in Amazon Marketplace Optimization. We are able to offer unique insights and perspectives into each critical area of your Amazon Business from Orders & Payments to Human Resources. Learn more about how we can help answer your questions related to Buy With Prime here.

How Will You Grow Your eCommerce Company?

When growth is elusive, I am an expert at asking incisive questions to surface the real issues and then present straightforward ideas that your team can actually implement.

Mistakes are expensive. They cost money, of course. What’s worse is the opportunity cost. I work with investors and management teams worldwide to help them get a handle on their digital business plans to execute a clear path forward.

For more on Amazon and Shopify, you might also like: