Are Shopify's Enterprise and Shop Pay's Ambitions at Odds?

How Would I Describe Shopify?

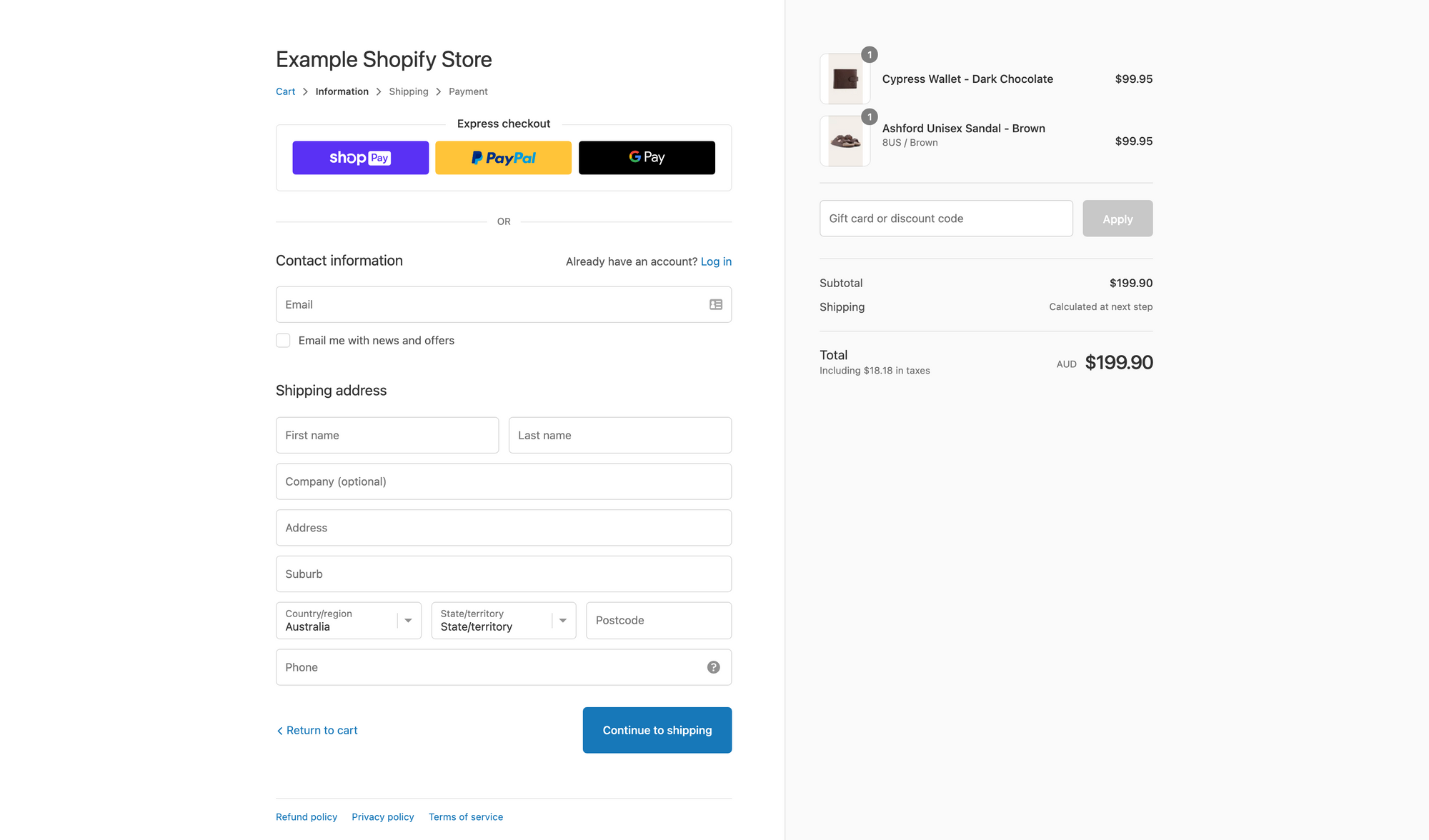

Over the last 20 years, we have yet to see a company like Shopify: an eCommerce platform that is opinionated about payments.

If you put a gun to my head, the Shopify of 2023 is a payments company that requires you to adopt an eCommerce platform. Checkout, and more specifically Shop Pay is the straw that stirs the drink.

What Is Shop Pay?

From the last earnings call, Shop Pay has something like 56+% and fast-growing percentage of Shopify's GMV. Plus, Shopify’s Merchant Services revenue - which you have to assume the majority is Shop Pay-derived - has been growing at least 2x faster than Shopify’s Subscription Services revenue for years now.

Since Shop Pay's announcement in 2017, It's been a boon for the platform. Shopify's checkout approach, while it seemed like a solved problem, has benefited from Shopify's singular focus of vertically integrating a payments stack, built on Stripe's infrastructure.

In short, while Shop Pay started as a way to monetize GMV, now it’s become the primary monetization instrument at Shopify. Even on investor earings calls, President Harley Finkelstein talks about GMV attach rate which essentially translates to: “How many dollars of revenue can we attach to each dollar of GMV we generate?”

What are the Challenges for Shopify’s Enterprise Strategy?

Shop Pay is one thing. It applies to Shopify Plus mainly, but also the lower tiers of Shopify.

Shopify’s new Enterprise offering is another mattter: Commerce Components by Shopify. Shopify has said that this offering is for retailers above $500M in sales. (I don’t believe it for a second, but Harley said it so it must be true, right?) In that segment, eCommerce is still in the 15% range as a percentage of all retail dollars. This means that tetail is on the bigger side of that 80/20 rule. Pareto is a good principle for a reason.

Traditional Enterprise software sales to a retailer mean large existing POS installations and Enterprise payment contracts. This is unfamiliar territory for Shopify, but the company seems willing to learn.

As Shopify navigates the next 5 years, here are the questions it needs to answer:

Is Shopify willing to imagine a world where Shop Pay is not the default Shopify Checkout provider? What if Adyen were configurable out of the box and the rest of everything else was the same? (Stop me if you’ve heard this before — I’m not holding my breath 😮💨)

Is Shopify willing to lose Enterprise deals over its opinionated payments approach? (The answer so far appears to be yes, but for how long? 🕰️)

If Shopify is willing to open its crown jewel fully -- that payments kimono 👘 -- what would that mean for Shopify's revenue growth and margins?

Is Shop App essential for the future or nice to have?

Is Shop Cash core, or just an extra incentive?

Is Shopify Flexible Enough to Support Multiple Payment Providers?

In theory, Shopify Checkout is already flexible enough to support multiple payment providers. In practice, Shop Pay is intertwined with the future of Shopify, and the answer is "it's complicated."

A component-oriented approach is just that -- take the components you need. However, to Shopify, some components are more important than others in the Shopify world.

To use the analogy of a human, Shop Pay is the heart of Shopify. It may be one component that Shopify does not want to swap out 100%.

It really gets to the heart of the question "What is Shopify?".

Tobi knows, and he is said to be "dragging the company to the next thing." However, choosing that next thing is important because it will change how you think about Shopify today. Not to mention, the billions of dollars in market valuation dependent on the Shopify ecosystem.

What Is The Next Thing For Shopify & The eCommerce Landscape?

Shopify’s integration of Shop Pay has given the platform quite the advantage over the years. Still, Shopify is looking to expand its reach beyond eCommerce and move up-market. This comes with many new challenges, especially in balancing its payments strategy with the demands of enterprise clients and the retail sector. It’s important to understand the importance of flexibility and integration in eCommerce if you’re looking to grow your business. Ultimately, the future of Shopify depends on its ability to meet the needs of its customers through continuously adapting and evolving. The eCommerce landscape is rapidly changing and Shopify, like many others, will need to continue to find ways to innovate.

Expert Consulting: How Will You Grow Your eCommerce Company?

When growth is elusive, I am an expert at asking incisive questions to surface the real issues and then present straightforward ideas that your team can actually implement.

Mistakes are expensive. They cost money, of course. What’s worse is the opportunity cost. I work with investors and management teams worldwide to help them get a handle on their digital business plans to execute a clear path forward.

For more on Shopify, you might also like: